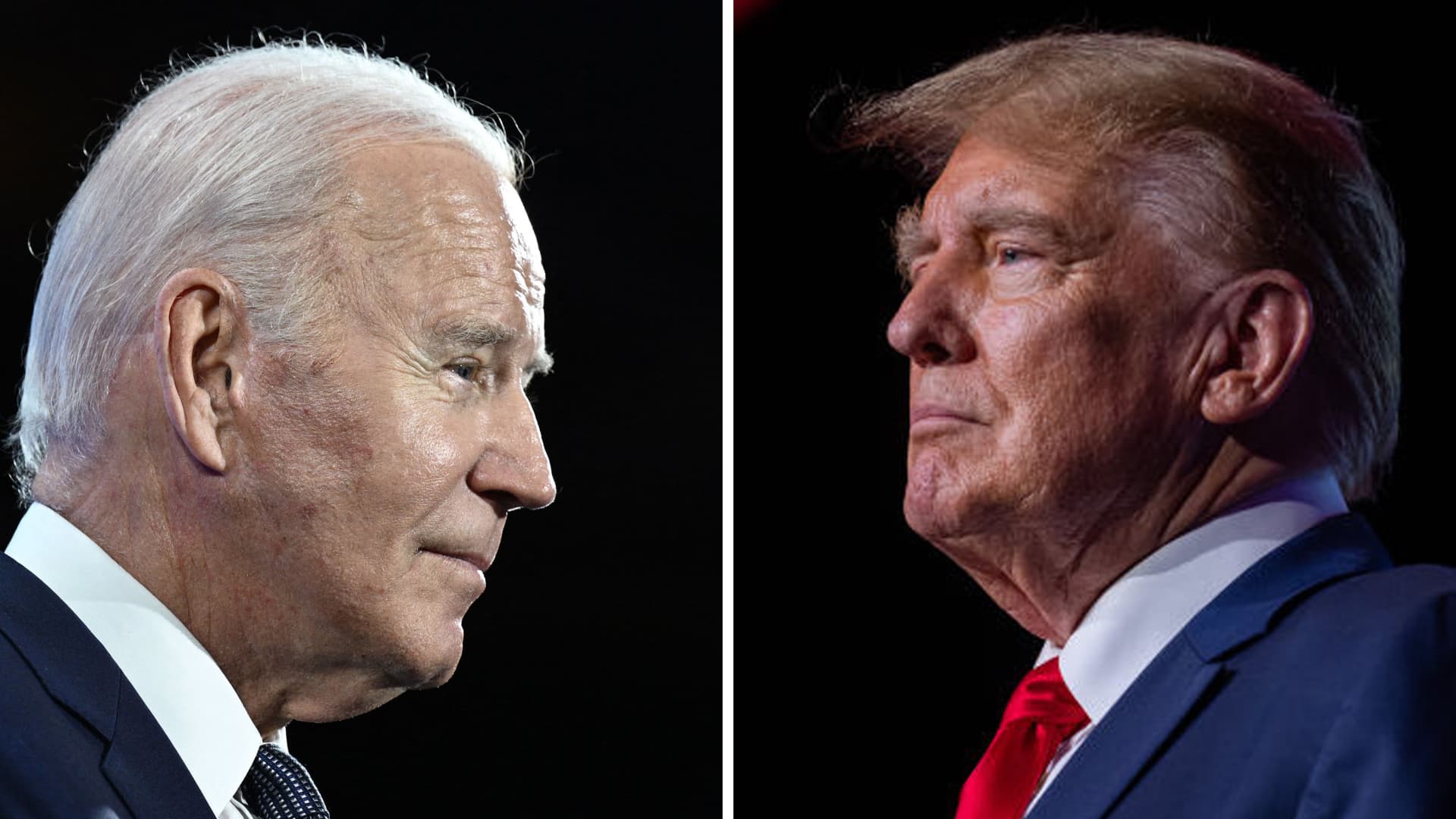

Joe Biden and Donald Trump 2024.

Brendan Smialowski | Jon Cherry | Getty Photographs

Presumptive nominees President Joe Biden and former President Donald Trump have each pledged to prolong expiring tax breaks for many People — however questions stay on the way to pay for it.

Trillions in tax breaks enacted by Trump through the Tax Cuts and Jobs Act of 2017, or TCJA, will expire after 2025 with out motion from Congress. This might enhance taxes for greater than 60% of filers, in response to the Tax Basis.

Expiring particular person provisions embody decrease federal earnings brackets, greater commonplace deductions, a extra beneficiant youngster tax credit score and extra.

However the federal funds deficit will probably be a “big sticking level” because the 2025 tax cliff approaches, stated Erica York, senior economist and analysis supervisor with the Tax Basis’s Heart for Federal Tax Coverage.

Extra from Private Finance:

This is how a lot homeownership prices yearly

Dwelling fairness is close to a file excessive. Tapping it could be difficult

Is it a terrific wealth switch or retirement financial savings disaster? It may be each, knowledgeable says

Absolutely extending TCJA provisions may add an estimated $4.6 trillion to the deficit over the subsequent decade, the Congressional Finances Workplace reported in Might.

The price of extending main elements of the TCJA has grown about 50% since preliminary estimates in 2018, in response to the Committee for a Accountable Federal Finances.

In 2018, the Congressional Finances Workplace estimated financial progress from the TCJA would cowl about 20% of the price of tax cuts. However the results have been smaller, research have proven.

“There is not any critical economist who thinks that the Tax Cuts and Jobs Act remotely got here near paying for itself,” stated Howard Gleckman, senior fellow on the City-Brookings Tax Coverage Heart. “And no one thinks that extending it or making it everlasting goes to pay for itself.”

There is not any critical economist who thinks that the Tax Cuts and Jobs Act remotely got here near paying for itself.

Howard Gleckman

Senior fellow on the City-Brookings Tax Coverage Heart

Proposals from Biden and Trump

Trump needs to increase all TCJA provisions and Biden plans to increase tax breaks for taxpayers who make lower than $400,000, which is most People.

Biden’s prime financial advisor, Lael Brainard, in Might known as for greater taxes on the ultra-wealthy and firms to assist fund TCJA extensions for middle-class People. By comparability, Trump has renewed his assist for tariffs, or taxes levied on imported items from one other nation.

Nonetheless, these coverage proposals are unsure, significantly with out figuring out which celebration will management the White Home and Congress.

Supply hyperlink