MANAGEMENT ISSUES

MICHAEL PLANTE and KUNAL PATEL, Dallas Federal Reserve Financial institution

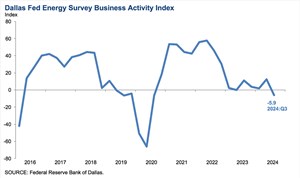

Fig. 1. The enterprise exercise index decreased from 12.5 within the second quarter to -5.9 within the third quarter.

Exercise within the oil and fuel sector declined barely in third-quarter 2024, based on oil and fuel executives responding to the Dallas Fed Vitality Survey. The enterprise exercise index, the survey’s broadest measure of the circumstances that power companies face within the Eleventh District, decreased from 12.5 within the second quarter to -5.9 within the third quarter, Fig. 1. The enterprise exercise index was 0 for exploration and manufacturing (E&P) companies, in contrast with -18.1 for providers companies, suggesting exercise was unchanged for E&P companies however declined for service companies.

OVERVIEW

The Dallas Fed conducts the Dallas Fed Vitality Survey quarterly to acquire a well timed evaluation of power exercise amongst oil and fuel companies situated or headquartered within the Eleventh District.

Methodology. Corporations are requested whether or not enterprise exercise, employment, capital expenditures, and different indicators elevated, decreased or remained unchanged, in contrast with the prior quarter and with the identical quarter a yr in the past. Survey responses are used to calculate an index for every indicator. Every index is calculated by subtracting the proportion of respondents reporting a lower from the proportion reporting a rise.

When the share of companies reporting a rise exceeds the share reporting a lower, the index shall be better than zero, suggesting the indicator has elevated over the earlier quarter. If the share of companies reporting a lower exceeds the share reporting a rise, the index shall be beneath zero, suggesting the indicator has decreased over the earlier quarter.

Knowledge had been collected Sept. 11–19, and 136 power companies responded. Of the respondents, 91 had been exploration and manufacturing companies and 45 had been oilfield providers companies.

Particular questions this quarter deal with the impact of Waha Hub pure fuel costs on exercise; whether or not operators will ramp up completions, as soon as the perceived pure fuel pipeline bottleneck within the Permian basin is cleared; whether or not crude oil manufacturing within the Permian basin shall be constrained between now and 2026 by pipeline constraints; plus a number of questions on oilfield electrification.

OIL AND GAS PRICES/SUPPLY & DEMAND

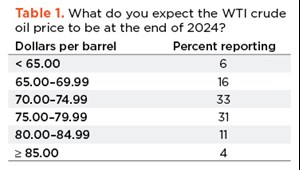

On common, respondents anticipate a West Texas Intermediate (WTI) oil worth of $73/bbl at year-end 2024; responses ranged from $55.00/bbl to $100/bbl, Desk 1. When requested about longer-term expectations, respondents, on common, anticipate a WTI oil worth of $81/bbl two years from now and $87/bbl 5 years from now.

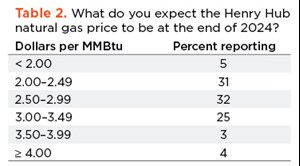

Survey members anticipate a Henry Hub pure fuel worth of $2.62/MMbtu at year-end, Desk 2. When requested about longer-term expectations, respondents, on common, anticipate a Henry Hub fuel worth of $3.24/MMBtu two years from now and $3.89/MMBtu 5 years from now. For reference, WTI spot costs averaged $70.82/bbl through the survey assortment interval, and Henry Hub spot costs averaged $2.23/MMBtu.

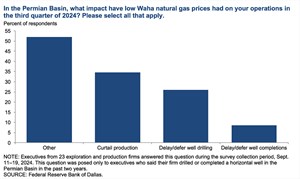

A particular query requested executives at E&P companies, “Within the Permian Basin, what impression have low Waha pure fuel costs had in your operations within the third quarter of 2024? The Waha Hub is a gathering location for pure fuel within the Permian Basin and connects to main pipelines. Of the executives surveyed, 52% chosen “different;” the most-cited cause was little to no impression on operations, adopted by decreased pure fuel income, Fig. 2. Thirty-five % stated low Waha Hub pure fuel costs brought on their agency to curtail manufacturing. Twenty-six % stated low pure fuel costs brought on them to delay/defer properly drilling, and 9% famous they delayed/deferred properly completions. Respondents had been capable of choose multiple selection for this particular query. Amongst those that chosen “different,” just one selected any of the remaining choices.

Fig. 2. Of the executives surveyed, 52% chosen “different;” the most-cited cause was the Waha Hub had little to no impression on operations, adopted by decreased pure fuel income.

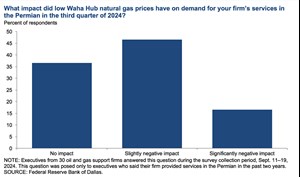

One other particular query requested executives at oil and fuel assist providers companies, “What impression did low Waha Hub pure fuel costs have on demand in your agency’s providers within the Permian within the third quarter of 2024? The vast majority of executives surveyed, 47%, stated low Waha Hub pure fuel costs barely, negatively affected demand for his or her agency’s providers within the Permian Basin within the third quarter, Fig. 3. Thirty-seven % famous no impression, whereas 17% % stated the low Waha Hub costs had a considerably damaging impression on demand for his or her agency’s providers within the basin in the newest quarter.

Fig. 3. Eighty % of executives stated they don’t seem to be planning to ramp up properly completion actions within the Permian basin, as soon as the pure fuel pipeline bottleneck clears.

FINANCIAL OUTLOOK

The corporate outlook index turned damaging within the third quarter, plunging 22 factors to -12.1, suggesting modest pessimism amongst companies. The general outlook uncertainty index jumped 25 factors to 48.6, suggesting mounting uncertainty.

OIL AND GAS PRODUCTION

Oil and fuel manufacturing was combined within the third quarter, based on executives at E&P companies. The oil manufacturing index elevated from 1.1 within the second quarter to 7.9 within the third quarter, suggesting oil output elevated barely within the quarter. In the meantime, the pure fuel manufacturing index declined from 2.3 to -13.3, suggesting pure fuel output decreased within the quarter.

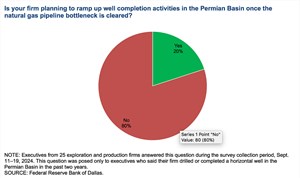

A particular query to executives at E&P companies requested, “Is your agency planning to ramp up properly completion actions within the Permian basin, as soon as the pure fuel pipeline bottleneck is cleared?” Eighty % of executives stated they don’t seem to be planning to ramp up properly completion actions within the Permian basin, as soon as the pure fuel pipeline bottleneck clears, Fig. 4. The remaining 20% stated their agency plans to take action.

Fig. 4. Ninety-two % of executives stated they don’t anticipate their agency’s crude oil manufacturing to be restricted between now and the tip of 2026, on account of crude oil pipeline capability constraints within the Permian.

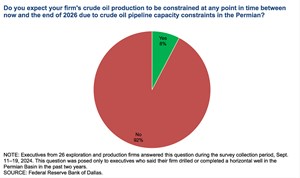

A further particular query requested executives at E&P companies, “Do you anticipate your agency’s crude oil manufacturing to be constrained at any time limit between now and the tip of 2026, on account of crude oil pipeline capability constraints within the Permian?” Ninety-two % of executives stated they don’t anticipate their agency’s crude oil manufacturing to be restricted between now and the tip of 2026, on account of crude oil pipeline capability constraints within the Permian, Fig. 5. The remaining 8% stated that they anticipate constrained manufacturing.

Fig. 5. Eighteen % of executives stated their agency’s oilfield operations are already totally electrified.

OFS SECTOR

Prices rose however at a slower tempo in comparison with the prior quarter. Amongst oilfield providers companies, the enter price index fell from 42.2 to 23.3. Amongst E&P companies, the discovering and growth prices index declined from 15.7 to 9.9. In the meantime, the lease working bills index edged decrease from 23.6 to 21.3. Two of the three price indexes trailed the collection common, suggesting prices are rising at a slower-than-average tempo.

The gear utilization index for oilfield providers companies turned damaging, declining from 10.9 within the second quarter to -20.9 within the third. The working margin index fell sharply from -13.0 to -32.6, suggesting margins declined at a sooner tempo. The costs obtained for providers index was comparatively unchanged at -2.3.

EMPLOYMENT TRENDS

The combination employment index was unchanged at 2.9 within the third quarter. Whereas that is the fifteenth consecutive constructive studying for the index, the low-single-digit end result suggests little-to-no internet hiring. The combination worker hours index declined from 8.1 to -2.3. Moreover, the mixture wages and advantages index decreased from 24.0 to 18.6.

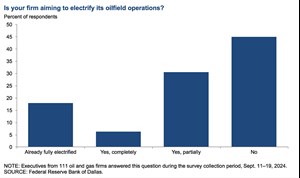

OILFIELD ELECTRIFICATION

Three particular questions targeted on issues associated to oilfield electrification. The primary of those requested all corporations, “Is your agency aiming to affect its oilfield operations?” Eighteen % of executives stated their agency’s oilfield operations are already totally electrified, Fig. 6. Six % of executives stated they goal to utterly electrify oilfield operations for his or her agency, and an extra 31% stated they anticipate to partially electrify operations. The remaining 45% stated they don’t plan to take action.

Fig. 6. A majority of executives—54%—stated the present lead time for electrical elements, resembling transformers, just isn’t multiple yr.

Responses differed, relying on the agency’s measurement and sort. Twenty-eight % of the executives surveyed from small E&P companies (crude oil manufacturing of fewer than 10,000 bpd, as of fourth quarter 2023) stated their oilfield operations are already totally electrified, in contrast with 9% of executives from oil and fuel assist providers companies and 6% of enormous E&P companies (manufacturing of 10,000 bpd or extra). Service companies had been additionally barely extra probably than small and enormous E&P companies to point that they don’t seem to be aiming to affect their oilfield operations.

A second query requested respondents, “What’s the present lead time for electrical elements, resembling transformers?” A majority of executives—54%—stated the present lead time for electrical elements, resembling transformers, just isn’t multiple yr. Twenty-one % of executives stated the lead time is multiple yr however no more than two years. A further 10% of executives stated greater than two years however no more than three years. No executives stated three years or extra. Fifteen % of executives famous there isn’t any lead time for electrical elements, resembling transformers.

The third and ultimate query requested executives, “What’s the prime problem to electrifying oilfield operations?” Corporations aiming to affect oilfield operations, or which have already achieved so, had been requested whether or not their operations had been primarily targeted on the Permian basin or outdoors the Permian basin. Amongst companies primarily targeted on the Permian basin, the highest chosen problem was “uncertainty about future entry to the grid” (29%), adopted by “different” (25%). Essentially the most-cited cause for “different” was challenges with grid infrastructure. Amongst companies primarily targeted outdoors the Permian, the highest chosen problem was “too costly” (30%), adopted by “lead instances for gear” (26%).

Amongst respondents not trying to electrify, the most-cited response was “too costly” (48%), adopted by each “uncertainty about future grid stability” and “different,” which had been every chosen by 17% of respondents.

COMMENTS FROM SURVEY RESPONDENTS

These feedback are from respondents’ accomplished surveys and have been edited for publication. Feedback from the Particular Questions survey could be discovered beneath this set of feedback. Editor’s observe: These feedback had been supplied in mid-September, properly earlier than the nationwide election on Nov. 5. Little doubt, among the considerations expressed about regulatory insurance policies have been allayed by the election outcomes.

EXPLORATION AND PRODUCTION (E&P) FIRMS

- Current volatility has began to impression planning discussions for 2025. We have now not adjusted our plan but, however we’re beginning to work on potential drilling plans for a decrease commodity atmosphere.

- The political uncertainty just isn’t serving to the market.

- The uncertainties on account of authorized assaults, cumbersome insurance policies and invasive laws create extreme hurdles for small E&P operators.

- There may be better uncertainty surrounding the economic system and the oil market. A lot of this has to do with the election uncertainty and the anticipated impression on the general market.

- Pure fuel manufacturing within the Permian basin is priced properly beneath the futures market. A number of of the previous months I’ve obtained nothing or a damaging adjustment to income for pure fuel. In June, one operator paid $0.09 per million cubic ft, which is above $0, however accrues little to my income. I consider this example will persist for months if not years.

- We’re seeing pure fuel costs have an effect on drilling rig utilization within the East Texas Basin. The Jap Haynesville drilling rig utilization is dropping off, and drilling rig utilization within the Western Haynesville/Bossier Sands play is rising, on account of greater manufacturing charges being discovered there.

- Oil inventories are rising, inflicting downward strain on the per-barrel worth of oil. Instability in Ukraine and the Center East is a trigger for concern for long-term oil and fuel deliveries, which OPEC is much less influential on. My opinion would counsel an elevated oil worth in 2025.

- If we do not change from the present U.S. administration, oil costs and the oil trade will decline, and we’ll develop into extra depending on overseas oil imports—hurting our economic system and dropping good-paying oil trade jobs.

- Turbulent commodity pricing markets, particularly WTI (West Texas Intermediate) crude oil and Henry Hub pure fuel, don’t enable for assured future efficiency projections in the case of internet revenue. Merger and acquisition (M&A) markets are sluggish with an absence of high quality belongings and decrease deal quantity by deal depend. Giant company mergers are main the M&An area, as belongings are reshuffled and the bigger corporations attempt to create shareholder returns outdoors of the drill bit. We’d like a more healthy M&A market to develop our firm through acquisitions.

- The recession scare is entrance and middle. The presidential election is a facet present by way of precise results for many power companies. Because the Fed [Federal Reserve] cuts charges, the economic system is both headed for a recession, which is dangerous information for oil, or one way or the other, we are going to handle the primary mushy touchdown within the historical past of the nation. For oil and fuel corporations, they may, sadly, be punished till the mushy touchdown outlook is definitely within the rearview mirror. Nobody needs to spend money on oil and fuel. Sentiment has thawed very barely from zero traders to at least one or two on the margin. It’s simply brutal on the market.

- Our firm outlook may improve, if the manager management shifts to conservative.

- The dearth of investor curiosity in oil and fuel exploration is a matter affecting our firm. One other situation is a lower in oil and fuel revenues, on account of depletion and decrease costs.

- Oilfield working price inflation is a serious concern within the trade.

- Regulatory uncertainty and adjustments are affecting our firm.

- The administration’s “demise by a thousand cuts” retains impacting my firm in several quadrants. All are geared toward rising the price of doing enterprise in oil and fuel and geared toward preserving oil and fuel independents from staying in enterprise.

Oil and Fuel Assist Companies Corporations

- The consolidation and shutting down of oilfield service companies will damage the flexibility of the U.S. to ramp up within the face of worldwide provide disruptions.

- Lead instances for electrical elements (transformers, capacitor banks, reclosers) have elevated from 10–12 weeks to 100–120 weeks, and prices are up 50–80%. There’s no approach the projected elevated demand for electrical energy (pushed by information facilities and/or synthetic intelligence) shall be achievable in the timeframe projected.

- I feel [there will be] no change till the election. Oil is down an alarming quantity, however my purchasers have me busy.

- The present disconnect between oil worth and bodily provide is worrisome. Costs aren’t supportive of the long-term investments wanted to keep up satisfactory provides via the power transition. In consequence, the present underinvestment will result in important stock shortfalls within the medium time period, adopted by fast worth escalation. It will be a really bumpy experience … once more.

- We’re listening to and seeing a continued reining in of exercise from our clients, as a result of uncertainty concerning the November elections. There may be work on the market, however it’s simply being held till there may be some certainty concerning power coverage.

- Center Jap politics appear to play much less and fewer of a think about figuring out the value of oil, and the value an increasing number of displays worldwide economics.

- Consolidation of operators within the upstream sector continues to ripple via the service sector. Much less continuity of labor makes it exhausting to keep up expert labor.

- Exercise ranges are up barely, however the market nonetheless feels cautious. Whether or not the warning is pushed by the continual M&A or the election is unclear to us. As a smaller service firm, the dimensions of the bigger operators is making it harder to entry items for smaller operators than we now have seen prior to now.

SPECIAL QUESTIONS COMMENTS

EXPLORATION AND PRODUCTION (E&P) FIRMS

- We stand by the speculation that the world is swiftly working out of $60 barrels on the best way to $100+ barrels throughout the subsequent 5 years. OPEC is being punished, quick time period, for ceding market share. To us, it seems to be a savvy “oil storage” coverage. U.S. shale will decline similarly to how Hemingway went bankrupt: “Progressively, then rapidly.” Why do you suppose very subtle companies, value tens of billions of {dollars}, are promoting out to the tremendous majors for fairness regardless of a market-leading Permian footprint?

- The oil group prefers to await the allocation of capital till after the election. Deflationary pressures in China proceed to curtail oil demand. India is shopping for low-cost Russian oil, which can be serving to cap world costs. Future OPEC+ manufacturing allotments are unsure. The dearth of a war-price premium in product costs is a priority. Technical evaluation of the current oil-price actions means that WTI may drop to round $55 per barrel, relying on whether or not the U.S. is getting into a recession.

OIL AND GAS SUPPORT SERVICES FIRMS

- Most of our rigs are able to working off grid energy, however the logistical (regulatory and allowing) hurdles that our clients should undergo to convey energy to the rig are formidable and costly.

- The Electrical Reliability Council of Texas and/or Public Utility Fee of Texas is combating regulatory framework round distributed era, behind-the-meter era and grid interconnections. Statutory necessities for utilities to approve grid interconnections haven’t any enamel; what ought to take three months now takes 12 to 18 months. Lead instances for intermediate voltage (~14KVa) transformers, and many others., are actually two to a few years, and utility-scale high-voltage elements are within the five-to-seven-year vary. Utility-scale battery backup prices roughly 10 to fifteen instances the price of pure gas-powered peaking services. Considerations about having the ability to meet projected demand pushed by AI and/or information facilities and/or bitcoin mining abound. Severe considerations about giant tech gamers locking up baseload and peaking energy provides and driving up the prices for customers additionally exist.

- I’m not satisfied that electric-powered autos and gear can maintain as much as the operational calls for positioned on them in our trade. That and the price of elements (particularly batteries) trigger many considerations. The continued rhetoric (principally political) about removing the fossil gasoline trade continues to be a sore spot with our firm, our workers and our clients. The contributions made by the oil and fuel trade have been the spine of our economic system for a really, very very long time. All “they” wish to deal with is among the pitfalls of oil and fuel exploration and manufacturing with out wanting on the nice strides our trade has made by way of effectivity, price discount and particularly security. Possibly “they” must learn the way a lot fossil-fuel merchandise impression their on a regular basis life.

- So as to add the extra prices to affect gear, the returns should be there via greater costs or decreased prices. That isn’t the case in our phase.

- Our operations are far too cellular and fast-paced to put in the required electrical infrastructure for operations. Moreover, suppliers are at present not making electrical choices for a lot of of our varieties of equipment.

MICHAEL PLANTE joined the Federal Reserve Financial institution of Dallas in July 2010 and is senior analysis economist and advisor. Current analysis has targeted on such subjects because the financial impression of the U.S. shale oil increase, structural adjustments in oil worth differentials, and macroeconomic uncertainty. He additionally has been the undertaking supervisor of the Dallas Fed Vitality Survey since its inception in 2016. Mr. Plante obtained his PhD in economics from Indiana College in August 2009.

KUNAL PATEL is a senior enterprise economist on the Federal Reserve Financial institution of Dallas. He analyzes and investigates developments and subjects within the oil and fuel sector. Mr. Patel can be closely concerned with manufacturing of the Dallas Fed Vitality Survey. Earlier than becoming a member of the Dallas Fed in 2017, he labored in a wide range of energy-related positions at Luminant, McKinsey and Co., and Financial institution of America Merrill Lynch. Mr. Patel obtained a BBA diploma from the Enterprise Honors Program on the College of Texas at Austin and an MBA diploma in finance from the College of Texas at Dallas.

Associated Articles

FROM THE ARCHIVE